What are PBMs?

Middlemen in the Pharmaceutical Supply Chain:

PBMs act as intermediaries between health insurance plans, pharmaceutical manufacturers, and pharmacies. They are responsible for administering and managing prescription drug programs for various health insurance providers.

What was the original purpose?

PBMs emerged in the 1960s as companies that processed insurance claims for prescription drugs. They aimed to streamline administrative processes, reduce prescription drug costs, and manage benefits overall.

What is the “function” of PBMs?

Negotiating Drug Prices: PBMs negotiate with drug manufacturers to secure lower prices for prescription medications.

Formulary Management: They develop and manage formularies, which are lists of medications covered by insurance plans.

Claims Processing: PBMs process and adjudicate prescription drug claims, facilitating transactions between pharmacies and insurance plans.

Network Management: They maintain networks of pharmacies that participate in their programs.

What do PBMs actually do?

Raise Drug Prices: PBMs often negotiate rebates with drug manufacturers based on the drugs' placement on formularies. The rebate system incentivizes the selection of higher-priced drugs, as manufacturers offer larger rebates for their products. While PBMs negotiate discounts and rebates with drug manufactures, they often pocket the majority of the “savings.”

Harm Pharmacists: PBMs pay pharmacists below costs through complex reimbursement models, the use of Direct and Indirect Remuneration (DIR) fees, and a lack of transparency in pricing. Pharmacies face financial challenges and delayed payments.

What is our mission?

Our mission is to reform PBM practices in Missouri.

PATIENT ACCESS - PHARMACY VIABILITY - FREEDOM OF CHOICE

PBMs are profiting at your expense.

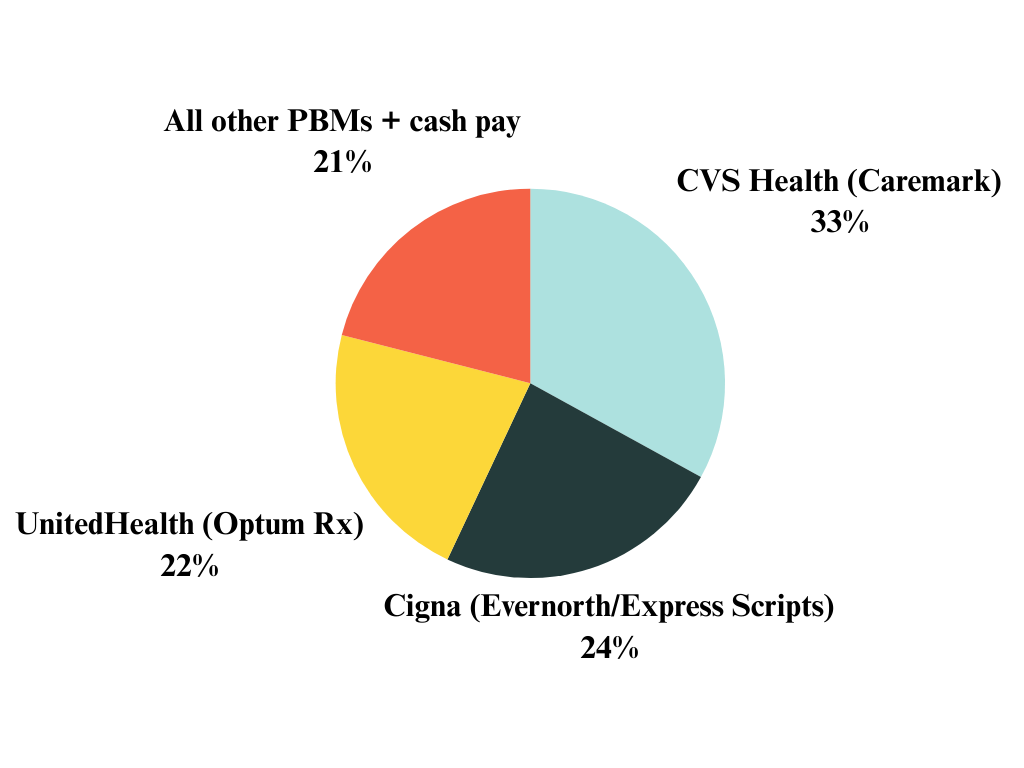

The dominance of three major PBMs in the market has led to substantial profitability, positioning them among the Fortune 25 companies. Over time, these PBMs have surpassed the rankings of drug manufacturers, despite their primary role being the control of their drug prices.

Pharmaceutical Costs and Economic Strain

In essence, the staggering rise in pharmaceutical care costs has created a stark contrast between the financial landscape of a full-time worker in 1985 and one in 2022. Back in 1985, the average man working full-time could sustain a family with just 40 weeks of income, leaving an additional 20% of the year's earnings to address miscellaneous expenses and savings. Fast forward to 2022, and a comparable full-time worker finds himself laboring throughout the entire year, yet falling short by ten weeks in meeting the financial demands. This alarming discrepancy highlights the grim reality that the promised prosperity has not materialized, despite the assertions made by economists.